taxing unrealized gains is unconstitutional

Such unrealized gains are hard to estimate with precision and billionaires would probably pay their accountants a fortune to avoid paying a tax on them. Fifth a tax on unrealized capital gains is flatly unconstitutional.

Washington State Capital Gains Tax Marches On What The New Law Would Do And Who Is Affected Geekwire

In sum the Democrats proposed new tax on unrealized capital gains is likely an unconstitutional wealth tax and if it passes the Treasury may find itself forced to spend.

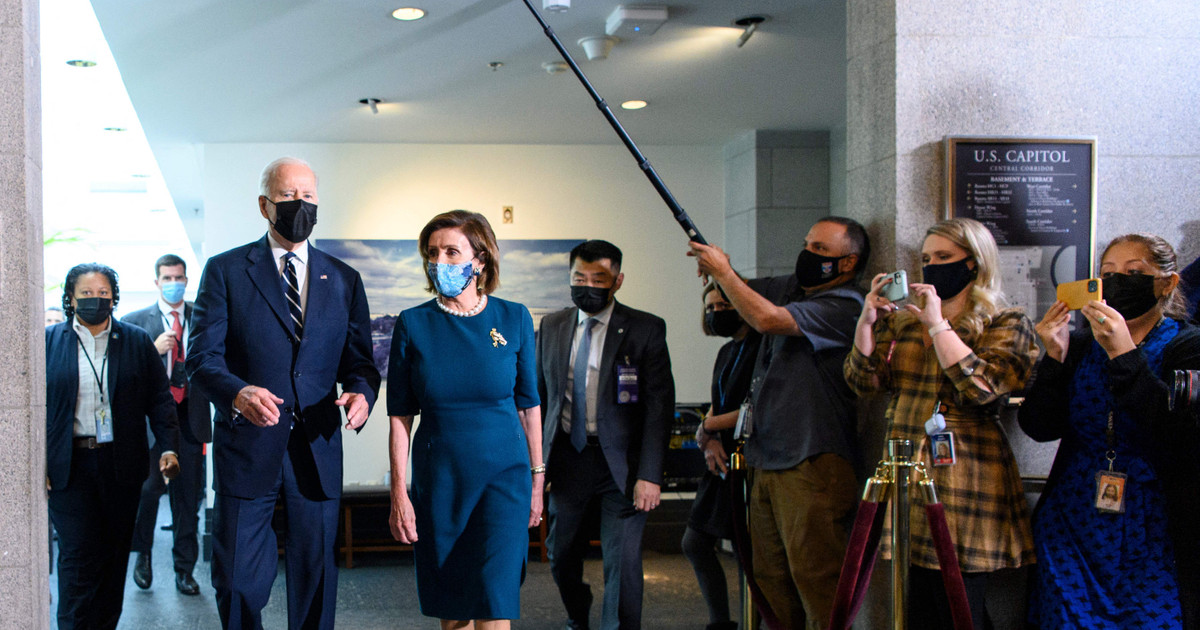

. It also may be. Bidens Treasury Secretary said yesterday that she wants to tax the unrealized capital gains in order to pay for Bidens 35 trillion dollar agenda. The proposal taxes unrealized gains.

In practice it would be an unworkable and arguably. But is there income before gains are realized. A tax on unrealized capital gains might be unconstitutional.

You see the Constitution. The 16th amendment allows congress to levy taxes on INCOME. Under current tax law unrealized gains are.

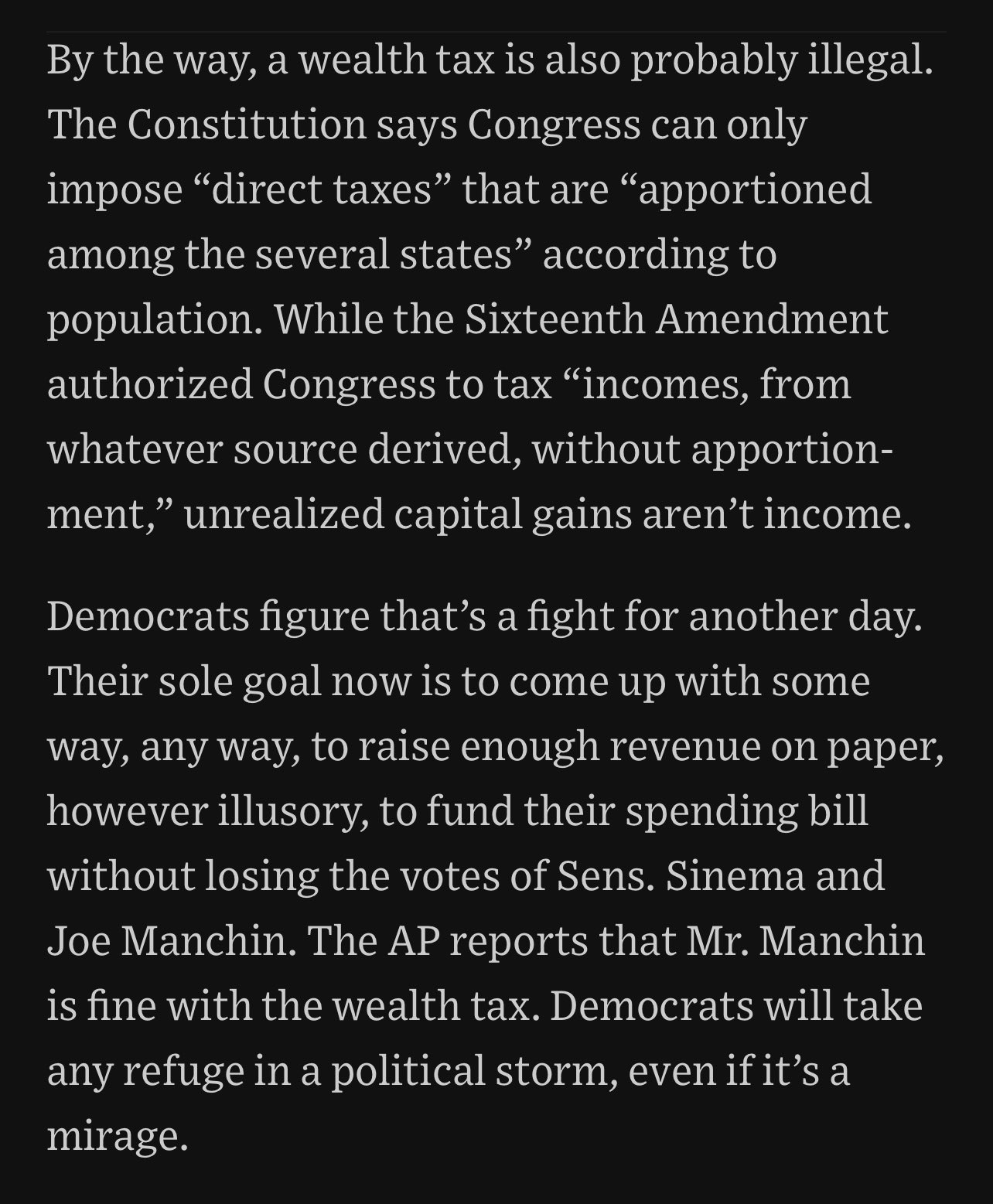

The only way to ensure that bills arent passed is to put only for Congress in the front and see how well they. The courts will decide if this goes forward but the idea is dubious at best. If mark-to-market taxation of capital gains is a direct tax is not covered by the 16 th Amendment and is not apportioned then it is unconstitutional.

A broadly based federal mark-to-market tax on unrealized capital gains would almost certainly be unconstitutional unless apportioned among the states which would be. No matter how Biden tries a tax on unrealized capital gains is never going to be an income tax Like the Democrats proposal from last year its unconstitutional. By taxing the investors income twice the government double-dips and potentially deters investment and.

A tax on unrealized gains is clearly not in compliance with Article I Section 9 nor is it covered under the 16th Amendment which the Supreme Court explicitly ruled in Eisner v. The Biden administrations idea to tax billionaires unrealized capital gains may sound good to the tax-the-rich crowd. An unrealized gain refers to the potential profit you could make from selling your investment.

The constitution may not even permit taxation of unrealized gains. December 6 2021 News. In other words if an asset is projected to make money but you dont cash in on that.

Any after-tax income used to invest is taxed again upon realized gains. There may be a slew of complications associated with a new plan that would subject affluent investors to taxation on the appreciation of their assets. And then theres the question of whether its even legal to tax unrealized capital gains.

Essentially what theyre doing is violating property rights Todd Graf. Democrats Cant Impose An Unrealized Gains Tax Because Its Unconstitutional. Janet Yellen proposed the idea of taxing unrealized gainsIts extremely unconstitutional.

Democrats proposed funding some of their multitrillion-dollar spending plan with a tax on the unrealized capital gains of anyone who makes more than 100 million per year or. Yes but it is clearly unconstitutional. UNREALIZED gains are NOT yet income.

Sen Manchin Stand Strong Taxing Unrealized Gains Is Un American State Journal Opinion Wvnews Com

Proposed Tax On Billionaires Raises Question What S Income The New York Times

Washington S Hunt For Revenue Turns Up An Unworkable Tax On Wealth Discourse

The Billionaires Tax Isn T New Propublica

Democrats Mull Tax On Assets Of Us Billionaires Kuwait Times

Ending Special Tax Treatment For The Very Wealthy Center For American Progress

Is There Any Logic Behind Taxing Unrealized Gains R Amcstocks

Explainer Democratic Billionaires Tax Proposal Likely To Face Legal Challenges Reuters

Biden S Billionaire Tax Is Neither Constitutional Nor Defendable

Ten Reasons To Be Concerned With Biden S 20 Percent Tax On Unrealized Gains Americans For Tax Reform

Here It Is Wyden S Unrealized Capital Gains Tax On Wealthy Americans Swfi

Taxing Unrealized Capital Gains At Death Proposal Tax Foundation

A More Constitutional Way To Tax The Rich Planet Money Npr

![]()

Taxing Unrealized Capital Gains The Crazy Fed Proposal To Tax Profits That Don T Exist Scottsdale Bullion Coin

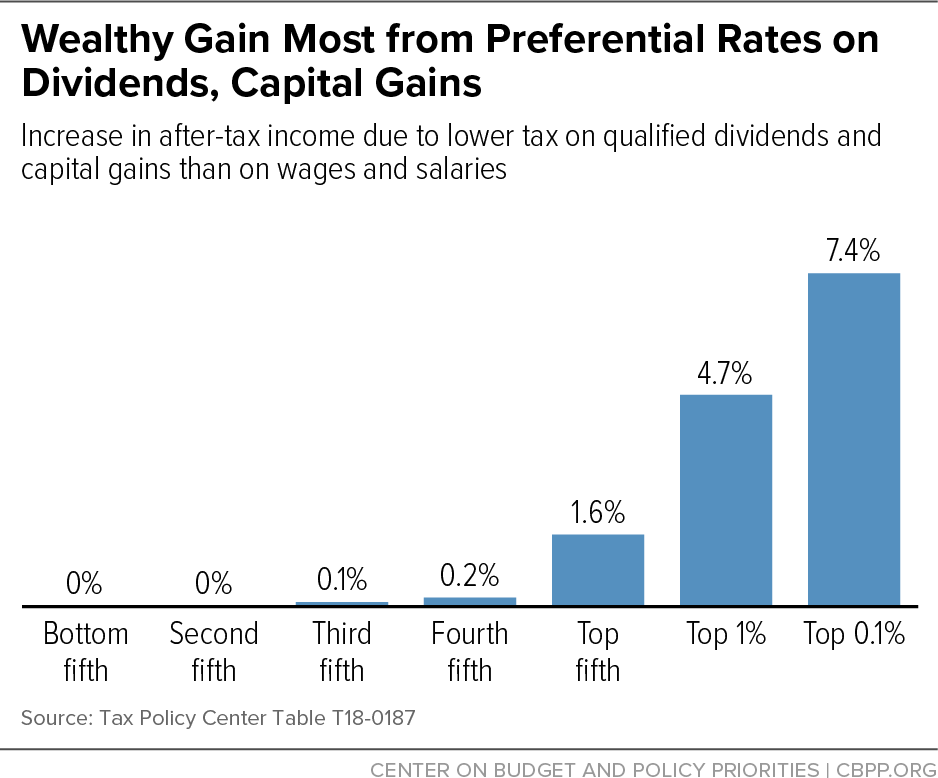

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Challenge To Washington S Capital Gains Tax Can Move Forward Judge Rules The Seattle Times

The Biden Administration S Cynical And Unconstitutional Proposed Tax On Wealth

Billionaire Tax How Democrats Want To Pay For Their Social Spending Bill Cnn Politics

Avik Roy On Twitter Good Wsjopinion Summary Of The Constitutional Problems With The Dems New Proposed Wealth Tax On Unrealized Capital Gains Unrealized Capital Gains Aren T Income And The Constitution Only